Inherited a House in the Bay Area in 2026? Your Probate Sale Checklist and Best Options

An inherited house in the Bay Area can feel like a blessing and a burden at the same time, especially when probate is involved.

Most families I talk to are juggling grief, paperwork, siblings with different opinions, and a property that still needs decisions made fast. If that’s you, take a breath. You don’t have to figure everything out today.

I’m Darin O’Brien, a Bay Area Realtor®, real estate book author, and an A.I. Certified AgentTM. In this post, I’ll walk you through a practical 2026 probate home sale checklist, plus the real options you have so you can choose what makes sense for your family.

Quick reminder: This is general information, not legal advice. Probate rules can vary based on your situation, so I always recommend confirming details with your probate attorney or estate professional.

Do you have to go through probate to sell an inherited house in the Bay Area?

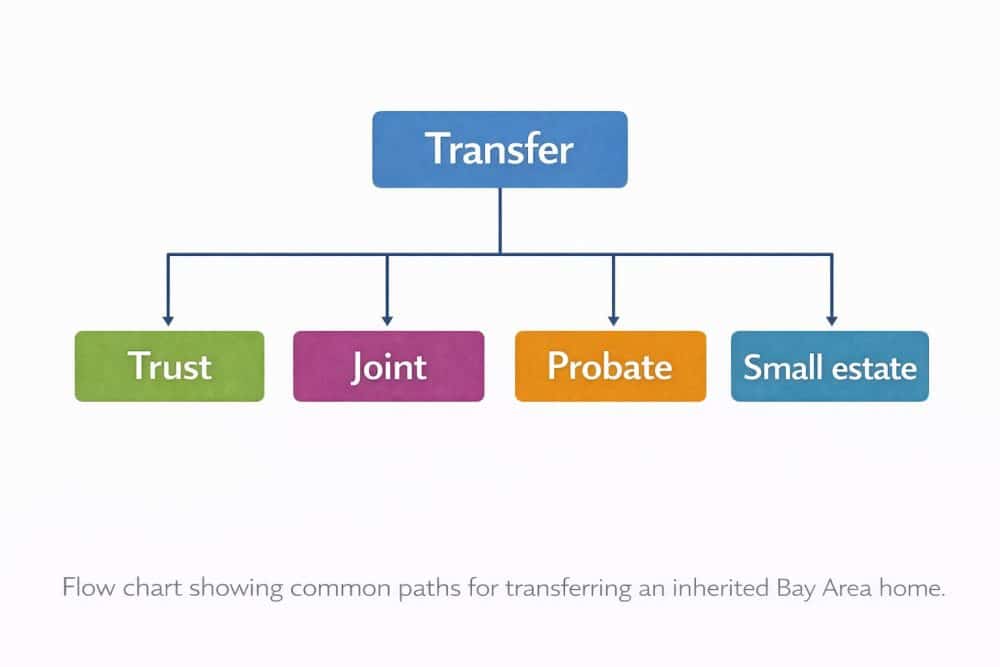

Sometimes yes, sometimes no, it depends on how the home was titled and what planning was done before the owner passed.

Here are common situations:

- Trust-owned property: Often sold by the successor trustee, usually with a smoother process.

- Joint ownership with right of survivorship: The home may transfer automatically to the surviving owner.

- No trust and titled in the deceased person’s name: Probate may be required.

- Small estate paths: In some cases, simplified procedures may apply.

My advice: Before you decide anything, confirm who has legal authority to sign, and what court process, if any, applies.

What should you do first after inheriting a house?

First, secure the home, gather key documents, and get clarity on decision-makers.

Here’s my “first 7 days” checklist:

- Secure the property: Locks, windows, garage, and any side gates.

- Forward mail: So you don’t miss bills, notices, or insurance documents.

- Confirm insurance coverage: Vacant homes can trigger policy issues if no one updates the carrier.

- Locate estate documents: Will, trust, death certificate, and any court filings.

- Identify the decision-maker: Executor, administrator, or successor trustee.

- Make a utility plan: Keep electricity and water on if the home needs showings or maintenance.

Big takeaway: Speed comes from organization. Organization starts with documents and authority.

2026 probate home sale checklist, what to do before you list

Before you list, your goal is to reduce uncertainty for buyers and reduce stress for your family.

Step 1: Confirm legal authority

- Who can sign listing paperwork and sale documents?

- Is court confirmation required in your situation?

- Are there multiple heirs who must agree?

Step 2: Get a clean picture of finances

- Mortgage balance, if any

- Property taxes and any delinquency

- Insurance status

- HOA status, if applicable

- Utilities and ongoing maintenance

Step 3: Decide how you will handle personal property

This is the part families underestimate.

- Keep, donate, sell, or dispose

- Create a timeline

- Decide who is responsible for removing items

Step 4: Assess the home’s condition

- Roof, foundation red flags, water damage

- Safety concerns

- Deferred maintenance

- Pest issues

Step 5: Choose your sale strategy

- Sell as-is

- Do targeted fixes

- Full prep and staging

What are your best options for an inherited Bay Area house in 2026?

Your best option depends on the home’s condition, the estate timeline, and whether the heirs agree.

Here are the main paths I walk families through.

Option 1: Keep the home and rent it

This can make sense if:

- The heirs want long-term income

- The home is in rentable condition

- You have a clear plan for property management and decision-making

Watch-outs:

- Ongoing maintenance and capital repairs

- Managing tenant issues with multiple heirs

- Tax and accounting complexity

Option 2: Keep the home and live in it

This can work if:

- One heir is buying out the others or there is a clear agreement

- Financing is realistic

- The home fits your life, not just your emotions

Option 3: Sell the home as-is

As-is can be the best “least stress” route when:

- The home needs work

- The estate wants a faster resolution

- The family does not want to coordinate repairs

Option 4: Fix, stage, and list for top dollar

This is the “maximize price” route when:

- The home is in a strong micro-market

- The expected return justifies the time and spend

- The estate can support a longer timeline

Big takeaway: The right option is the one that fits your timeline, family dynamics, and net outcome.

Should you sell the inherited home as-is or fix it up first?

Most families get the best result from targeted fixes, not a full remodel.

Here’s how I help you decide:

- If the home has major condition issues, as-is may protect your time and sanity.

- If the home is basically solid but looks tired, targeted prep can dramatically improve offers.

- If the home is already in good shape, presentation and launch become the value lever.

Targeted fixes that often matter most:

- Paint, lighting, and clean flooring

- Obvious safety items

- Curb appeal and landscaping

- Deep clean and odor removal

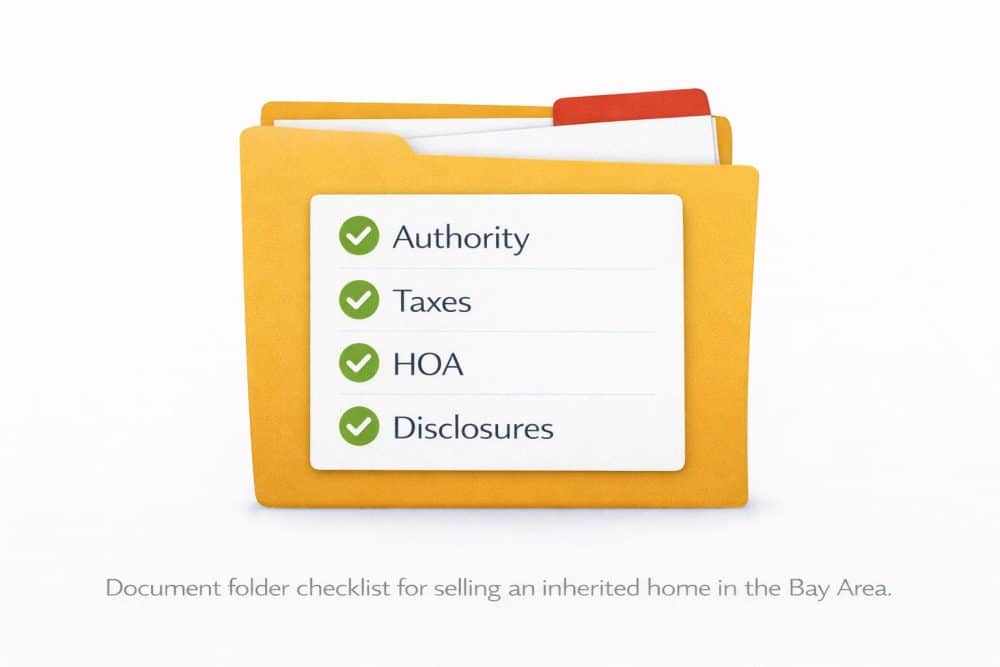

What paperwork do you need to sell a probate property?

You typically need proof of authority, property details, and the disclosures buyers expect in California.

In plain English, plan on:

- Proof of who can sign

- Property tax and utility information

- HOA documents if applicable

- Disclosures about the property’s condition

- Any inspection reports you choose to provide

If the home has been vacant, buyers will also ask about:

- How long it’s been vacant

- Any known leaks, pests, or repairs

- Any unpermitted work or open permits, if known

How long does it take to sell an inherited house in the Bay Area?

The timeline depends on whether probate is required, whether court steps apply, and how quickly the family can agree on a plan.

Here’s a practical way to think about it:

- Trust sale: Often the fastest path.

- Probate sale: Can take longer due to court timelines and required steps.

- Family alignment: If heirs agree quickly, everything moves faster.

- Condition and prep: A home that is cleaned out and presentable sells faster.

My advice: Don’t guess. Build a timeline based on your exact legal path, then choose the sale strategy that fits.

What are the most common mistakes families make with Bay Area probate sales?

The biggest mistakes are delays and disagreements that cost time, money, or both.

Here are the ones I see most often:

- Waiting too long to secure insurance properly

- Letting the home sit vacant without a maintenance plan

- Starting repairs before confirming authority and budget

- Not getting alignment between heirs early

- Trying to sell with clutter still inside

- Overpricing “just to see”

Big takeaway: A probate sale is a project. Projects need a clear owner and a clear plan.

How an A.I. Certified Agent helps in a probate sale

A probate sale involves more moving pieces than a normal sale, and an A.I. Certified Agent helps by keeping the process organized, communication clear, and marketing execution fast.

Here’s how I support families using a mix of hands-on guidance and A.I. assisted tools:

- Clear next-step planning: turning a messy situation into a simple checklist and timeline

- Faster coordination: keeping attorneys, heirs, vendors, and escrow aligned

- Stronger marketing execution: tighter listing messaging, better photo sequencing, and cleaner launch planning

- Cleaner feedback loops: organizing buyer questions and showing feedback so we can make decisions quickly

The technology supports the process. It doesn’t replace local experience, negotiation, or good judgment.

Conclusion

If you inherited a house in the Bay Area in 2026, you have options, and you don’t have to make a decision blind.

The simplest path forward is this:

- Confirm authority

- Secure the home and insurance

- Get the family aligned on a timeline

- Choose the right sale strategy, as-is or prepped

- Launch with clarity, so buyers feel confident

If you want a simple plan tailored to your situation, visit my landing page here

Frequently Asked Questions

About the Author: Darin O’Brien

Darin O’Brien is a native San Francisco East Bay Area REALTOR®, an author of books for buyers and sellers, and A.I. Certified Agent™. He works with JPAR® Iron Horse Real Estate, specializing in homes and luxury properties. Darin O’Brien, REALTOR® DRE #01359917